Table of Contents

Yes, and in fact, health insurance premiums for the self-employed in the US have been 100% deductible since 2003. This offers you the privilege to reduce your Adjusted Gross Income (AGI) by the amount of money you paid as an insurance premium that same year.

The reduction of your taxable income translates to tax savings for you.

Similar health insurance deductions for the self-employed are also possible in Canada but in the UK, you may need to buy a business health insurance policy to enjoy this benefit. However, health care is notably much cheaper in the UK than in the US which till today remains the only major industrialized country without universal healthcare according to the Journal of Business Venturing.1

In the US you remain entitled to deduct your health insurance premium for the year whether you bought your insurance coverage in your name or your business name as stated in a memorandum by the Inland Revenue Service (IRS).

what qualifies for a self-employed health insurance deduction

According to Valupenguin, the Internal Revenue Service is clear about the types of health insurance premiums that are deductible if you are self-employed. These are medical insurance, Dental, and Long term care insurance.(source)

Your insurance policy has to fall into any of these 3 types for you to stand any chance of a pretax deduction.

Any premiums you pay out of pocket for health insurance bought through the Federal marketplace are tax-deductible including those paid for insurance gotten via the Consolidated Omnibus Budget Reconciliation Act (COBRA).

Your deductible medical expenses are not restricted to health insurance premiums. Itemized qualifying medical expenses could be deductibles as well and include the costs of:

- Hospitalization,

- Insulin for the treatment of diabetes,

- prescription eyeglasses,

- Walking aids like crutches,

- Treatment for drug addiction,

- prescription drugs,

- Programs for weight loss on diseases diagnosed by doctors,

- Treatment and preventive dental costs,

- Hearing aids.

What doesn’t qualify for a self-employed health insurance deduction

Premiums that were not paid out-of-pocket are generally not deductible including medical costs for which you were reimbursed. Any part of your premiums covered by tax subsidy on insurance acquired through a state or federal marketplace is not deductible.

Any premium paid by an employer or obtained from a pretax income is also not deductible.

Who is eligible

1. Someone IRS recognized to be self-employed: You must be seen to be truly self-employed in the Internal Revenue Service’s (IRS) own terms which recognize your self-employment status only if:

- You are in a trade or business partnership

- You are a sole proprietor in a trade, business(including part-time), or an independent contractor.

2. Someone with qualifying health insurance coverage. Qualifying insurance coverages are in the area of:

- Medical insurance.

- Health insurance plans that were bought with advanced premium tax credits (APTC) through the Affordable Care Act marketplace on Healthcare.gov.

- Qualifying long-term care (LTC) insurance and Medicare premiums.

3. Someone whose business has a net profit for that year. This is necessary because you may only deduct as much as you’ve earned through your business.

4. Someone who receives wages from an S corporation. Being a more than 2% shareholder in the corporation is a benchmark for qualification.

5. Someone who has no other coverage. This includes employer-sponsored coverage or spouse’s employer.

Do sign up for our newsletter to keep in touch:

Who is not eligible

You’ll not be eligible to make the health insurance deduction in the following circumstances:

1. Eligibility for an employer-sponsored health insurance plan: This could be health insurance coverage by either:

- Your employer.

- Your spouse’s employer.

No premiums paid for the months in which you were eligible for employer coverage are deductible.

2. Unprofitable business: If your business suffered a net loss for the year you can’t take the deduction. If you have a string of businesses you may switch to the ones whose net profit is above the health insurance premium you paid for the year.

Whose coverage can be included

As a self-employed person, you’ll be entitled to a 100% deduction of your health insurance premiums under special personal deduction for:

- Yourself,

- Your Spouse,

- Your dependents,

- Your non-dependent children who are up to the age of 26 or younger.

The costs are to be filed on your personal tax return. These deductions to be made are only applicable to your Federal, State, and local income taxes and not self-employment taxes.

Healthcare insurance premiums paid for employees are to be filed as business expenses.

How to deduct health insurance premiums for self-employed

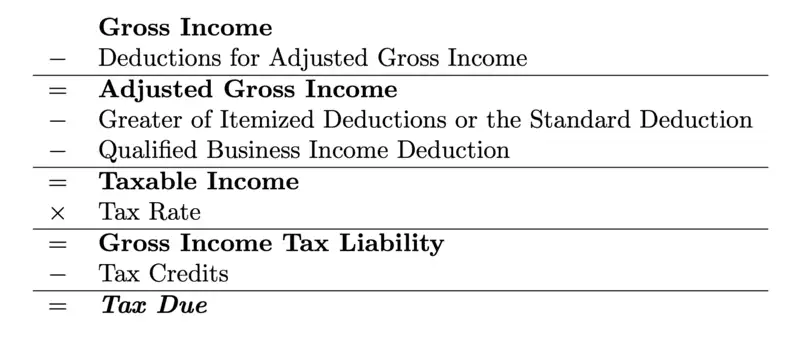

A good way to make health insurance premium costs claims is a deduction on your total gross income which gives you your adjusted gross income (AGI). This process has the following benefits:(source)

- Lowered tax debt. Since your tax liability is calculated based on your adjusted gross income, lowering it with your insurance premium will result in lower tax debt.

- The privilege of claiming 100% of health insurance premiums.

Health insurance premium deductions can be applied to your total gross income either as standard deductions or itemized. Though some states like Michigan and Massachusetts may not allow itemized deductions.

The rule of thumb in choosing between standard and itemized deductions is settling for the one that lowers your adjusted gross income the most. Share on XHowever, there can be a situation when you may settle for itemization even if its total is less than the standard deduction. This is when itemizing on Federal and state returns gives you larger tax benefits than you would get through a standard deduction.

Standard deductions

Most people prefer this method. Standard deductions are fixed amounts by which your taxable income is reduced. It varies in the following ways based on your status as an applicant:

- Single or married but filing separately: $12,550.

- Married filing as a couple, or widow(er): $25,100.

- Family head: $18,800.

The following circumstances increase the amount of your Standard deduction:

- Singlehood,

- Being blind,

- 65 years, or older,

- Being the head of a household,

- Marriage,

- Being a Widow, or widower.

The standard deductions are preferred due to the following advantages:

- Removes the stress that goes with itemizing deductions.

- You avoid the extra work of keeping records of expenses and receipts when audited by the Internal Revenue Service.

- Offers you the privilege of taking tax deductions when you’ve got no qualifying expenses for itemized deductions.

Itemized Deduction

An itemized deduction is calculated by adding up all qualifying health insurance premiums on which you want to make claims. This is then subtracted from your taxable income or adjusted gross income. Unlike the standard deduction, it’s not fixed and varies among taxpayers.

Itemizing your claims is advisable in the following situations:

- You incurred huge out-of-pocket medical expenses.

- The total of your itemized deduction is greater than the fixed standard deduction.

- You incurred other qualifying deductions like impairment-related expenses.

Whatever method of deduction you choose to go with, it’s expected to be the one that’s more favorable either by having the greatest impact In reducing your taxable income or giving you better tax benefits.

Health insurance premiums are of such significant concern to the self-employed so much so that an increase in premium by 1% could result in a 1.8% chance of becoming uninsured according to the quarterly Journal of Economics.2 Research has shown that households that enjoy these deductions are less likely to exit self-employment.3

You may want to learn about the cost of long-term care insurance or how to get health insurance.

References.

- Gumus, G., & Regan, T. L. (2015). Self-employment and the role of health insurance in the U.S. Journal of Business Venturing, 30(3), 357-374. https://doi.org/10.1016/j.jbusvent.2014.01.001 ↩︎

- Gruber, J., & Poterba, J. (1994). Tax Incentives and the Decision to Purchase Health Insurance: Evidence from the Self-Employed. The Quarterly Journal of Economics, 109(3), 701-733. https://doi.org/10.2307/2118419 ↩︎

- GURLEY-CALVEZ, T. (2011). WILL TAX-BASED HEALTH INSURANCE REFORMS HELP THE SELF-EMPLOYED STAY IN BUSINESS? Contemporary Economic Policy, 29(3), 441-460. https://doi.org/10.1111/j.1465-7287.2010.00202.x ↩︎

The information you offered on this site has helped me tremendously. Thanks for all of your time and effort.

Thanks for this great post. information presented in such a perfect means of writing?

Regards for this helpful content.

Magnificent! I wish to apprentice you for this clear and informative piece.